NON-RESIDENT

TAX STATUS CONFIRMATION LETTER

If you have already left the country or planning to leave, let us help you cease your South African Tax Residency. Ceasing your tax residency entails your declaration to SARS of your South African Non-Residence tax status. In order to do this, one must obtain a Non-Resident Tax Status Confirmation Letter from SARS.

CONFIRM YOUR NON-RESIDENCY WITH SARS

If you have already left the country or planning to leave, let us help you cease your South African Tax Residency. Ceasing your tax residency entails your declaration to SARS of your South African Non-Residence tax status. In order to do this, one must obtain a Non-Resident Tax Status Confirmation Letter from SARS.

ISSUING CONFIRMATION OF NON-RESIDENT TAX STATUS LETTERS BY SARS

As a Tax Resident, you are legally required to submit tax returns to SARS every year and declare your worldwide earnings (local and foreign) and then claim any exemptions or tax credits on the foreign earnings where applicable and qualifying.

Importantly, if you do not formally note yourself as anon-tax resident with SARS, then you will be seen as a tax resident in South Africa. Even if you have broken the tax residency tests; being the ordinarily residence test and physical presence test, or there is a Double Taxation Treaty in place, these factors are not going to automatically change your status to non-tax resident. The only way to change your tax status is to formally undergo the relevant legal processes through SARS.

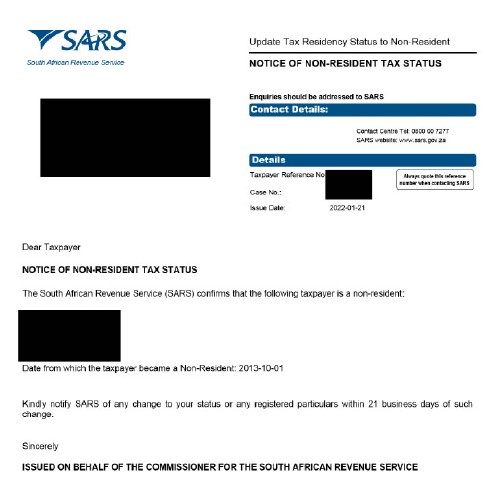

The “SARS Non-Resident Tax Status Confirmation Letter” is your golden ticket to financial emigration freedom (see example for reference). This letter was not previously a requirement of the emigration process.

WHAT IS A

NON-RESIDENT TAX STATUS LETTER?

The SARS Notice of Non-Resident Tax Status Letter. This letter confirms that you have ceased to be a tax resident of South Africa and indicates the effective date that tax residency was ceased. Taxpayers who have previously ceased tax residency and obtained the Emigration Tax Clearance Certificate (ETCC) or Tax Compliance Status (TCS) PIN for Emigration also require this letter.

To be able to apply for the SARS Notice of Non-Resident Tax Status Letter, one must meet the legal requirements to be considered a non-resident of South Africa for tax purposes, update their tax status on SARS eFiling profile and complete the verification process with SARS. SARS will then issue the confirmation letter.

When moving funds abroad, taxpayers must apply for the newly introduced Approved International Transfer (AIT) Tax Compliance Status (TCS) PIN with SARS, which is only valid for 12 months from the date of issue. If you apply for the AIT TCS PIN as a non-resident taxpayer, the above-mentioned letter is a strict requirement.

**Kindly note that this change took effect on 24 April 2023, combining the Emigration and the Foreign Investment Allowance (FIA) TCS PINs.

WHAT IS A NON-RESIDENT TAX STATUS LETTER?

The SARS Notice of Non-Resident Tax Status Letter. This letter confirms that you have ceased to be a tax resident of South Africa and indicates the effective date that tax residency was ceased. Taxpayers who have previously ceased tax residency and obtained the Emigration Tax Clearance Certificate (ETCC) or Tax Compliance Status (TCS) PIN for Emigration also require this letter.

To be able to apply for the SARS Notice of Non-Resident Tax Status Letter, one must meet the legal requirements to be considered a non-resident of South Africa for tax purposes, update their tax status on SARS eFiling profile and complete the verification process with SARS. SARS will then issue the confirmation letter.

When moving funds abroad, taxpayers must apply for the newly introduced Approved International Transfer (AIT) Tax Compliance Status (TCS) PIN with SARS, which is only valid for 12 months from the date of issue. If you apply for the AIT TCS PIN as a non-resident taxpayer, the above-mentioned letter is a strict requirement.

**Kindly note that this change took effect on 24 April 2023, combining the Emigration and the Foreign Investment Allowance (FIA) TCS PINs.

Book a free 30-minute consultation with our experts to assist you with your roadmap!

About Us

Our experienced team helps individuals and families navigate the complex process of relocating their financial assets abroad. Our mission is to provide you with peace of mind and a smooth transition to your new financial home.

Thank you for choosing us – We look forward to serving you!

Find Us

Johannesburg

17 Eaton Avenue

Bryanston

Gauteng

George

55 York Street

Dormehls Drift

George

Contact Us

Telephone:

South Africa: 011 467 0810

International: +27 11 782 5289

Contact

contact@financialemigration.co.za

©Copyright – Financial Emigration 2023